CDTFA Announces Increases to Cannabis Tax Rates Effective January 1, 2020

November 24, 2019

By Lauren Mendelsohn, Esq.

On November 21, 2019 the California Department of Tax & Fee Administration (CDTFA) announced that the cannabis tax rates will be going up on January 1, 2020. Specifically, as of that date, the cannabis mark-up rate will go up to 80%, after being set at 60% for the past few years. The CDTFA also issued a media alert the following day further explaining how the calculations would work with the new mark-up rate.

Cannabis goods sold at licensed retail outlets in California are subject to a 15% excise tax, which is calculated using the “average market price.” The average market price is defined differently depending on whether it resulted from an arm’s length transaction or a non-arm’s length transaction. In a nutshell, though this may be over-simplifying a little, the former involves a transaction between two independent parties while the latter involves a transaction between one party or two parties under the same control (for example, a vertically-integrated business).

The mark-up rate, which is an amount that the state assumes retailers are marking up products before selling them to consumers, is a factor in the tax calculation for arm’s length transactions as shown below:

Arm’s Length Transaction

Average Market Price = Wholesale Cost + Mark-up rate

Excise Tax = Average Market Price x 15%

Non-arm’s Length Transaction

Average Market Price = Gross Receipts from Retail Sale

Excise Tax = Average Market Price x 15%

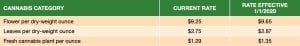

In addition to the mark-up rate for the excise tax increasing, CDTFA also announced that the cultivation tax rates are increasing due to inflation. Beginning January 1, 2020 the following tax rates will apply to cannabis legally cultivated in California:

Sales and transfers made prior to January 1, 2020 will be subject to the “current rate” listed in the chart, while any cannabis sold or transferred from a cultivator to a manufacturer or distributor after January 1, 2020 will be subject to the new rate. It should be noted that unlike the excise tax, which is paid by the consumer, the cultivation tax is paid by licensed cultivators once their cannabis enters the legal market — which could be before the cannabis is actually sold.

Thus, while cultivators will likely pass as much of the tax burden as possible down the line by charging other licensees more for their harvest, the weight-based cultivation tax increase could have a devastating impact on farmers, especially smaller operators, who are already suffering from the restrictions and requirements imposed on them by local and state governments and agencies.

WHY THE INCREASE?

Many people are wondering why the cannabis tax rates increased. In their Notice dated November 21, CDTFA stated:

The California Department of Tax and Fee Administration (CDTFA) is responsible for determining the cannabis mark-up rate every six months. An analysis of statewide market data was used to determine the average mark-up rate between the wholesale cost and the retail selling price of cannabis and cannabis products. Based on this analysis, effective January 1, 2020, the mark-up rate will be set at 80 percent.

And:

As required by the Cannabis Tax Law, effective January 1, 2020, the cultivation tax rates reflect an adjustment for inflation. The adjusted rates for each category shown below will be reflected on the monthly and quarterly cannabis tax returns beginning January 1, 2020.

In other words, the CDTFA is statutorily mandated to adjust the cultivation tax rates for inflation (see Revenue & Taxation Code §34012(k)), as well as mandated to determine a mark-up rate periodically (see Revenue & Taxation Code §34010(b)(1)).

However, it should be noted that the tax regulations do not say that the mark-up rate must increase each time it is assessed; rather, it simply says that the mark-up will be “determined by the department on a biannual basis in six-month intervals.” §34010(b)(1). “Determined” means the mark-up rate for the excise tax could go up or down. And although the law requires that the cultivation tax be “adjusted” for inflation, the cost of cannabis is not necessarily tied to the regular inflation rate; in fact, if things are working right, the cost of legal cannabis should be going down over time.

We contacted the Bureau of Cannabis Control for comment on these tax increases, but as of time of publication they have not responded. We also reached out to Nicole Elliott, the Cannabis Advisor to California Governor Gavin Newsom, for her take on these tax increases, and she responded that “law is often a blunt instrument, not a scalpel. In this case this instrument is also clearly confusing. We (collectively) have an obligation to constantly do a critical review of the framework & it feels like this area may benefit from that.”

SEPARATING “CANNABIS” FROM “CANNABIS ACCESSORIES” COULD HELP

A few months ago, CDTFA adopted Regulation 3700, which dealt with the cannabis excise and cultivation taxes. We previously discussed Regulation 3700 here. This created a new definition for “wholesale cost” that includes transportation charges but does not add back any discounts or trade allowances. Regulation 3700 also clarified that cannabis accessories are not subject to the 15% excise tax. To take advantage of this, however, the distributor must separately state the sales price of the cannabis or cannabis products sold or transferred with cannabis accessories (for example, vape cartridges) to a cannabis retailer.

Thus, one way to reduce the impact of the increased tax rates is to ensure that all cannabis and cannabis accessories are listed and priced out separately on all invoices, so that only the cost of the cannabis itself would be taxed, not the value of the accessories.

POTENTIAL IMPACT OF TAX RATE INCREASES

Failure to pay the correct amount of tax could result in penalties. 18 C.C.R. §3700(k) provides:

Penalty for Unpaid Taxes. In addition to any other penalty imposed pursuant to the Fee Collection Procedures Law (commencing with section 55001 of the Revenue and Taxation Code) or any other penalty provided by law, a penalty of 50 percent of the amount of the unpaid cannabis excise tax or cannabis cultivation tax shall be added to the cannabis excise tax and cultivation tax not paid in whole or in part within the time required pursuant to sections 34015 and 55041.1 of the Revenue and Taxation Code.

Moreover, these tax increases will likely have a chilling effect on California’s legal cannabis market, which is already struggling to gain a foothold across the state. Consumers will have to pay even more than they already do, which could lead many to purchase cannabis on the illicit market where taxes aren’t a concern. This is not only unsafe from a public health perspective (just look at the vaping crisis, which can be largely traced to cartridges bought from unlicensed sources), but will also make it more difficult for licensed operators to survive as they struggle to compete against operators who aren’t faced with these kinds of burdens. We also have not even mentioned local taxes, which are frequently imposed on cannabis businesses and are entirely separate from the state-imposed taxes discussed here.

In conclusion, we are concerned about the impact that these tax increases will have on the ability of California’s regulated cannabis market to survive. We urge lawmakers to take steps to change the manner in which cannabis taxes are calculated as well as to reduce the overall tax burden on this emerging industry.

This information is provided as a public educational service and is not intended as legal advice. For specific questions regarding California’s cannabis laws and regulations, including questions related to cannabis taxes, please contact the Law Offices of Omar Figueroa at (707) 829-0215 or info@omarfigueroa.com to schedule a confidential legal consultation.