Understanding the Corporate Transparency Act: Key Insights for Cannabis Business Owners

by Omar Figueroa & Lauren Mendelsohn

May 6, 2024

Insignia of the Financial Crimes Enforcement Network (FinCEN)

In recent years, the U.S. government has introduced several measures to combat illicit financial activities, with the Corporate Transparency Act (CTA) of 2019 being one of the most significant. Aimed at enhancing transparency within legal entities such as corporations and limited liability companies, the CTA is especially pertinent for owners of regulated cannabis businesses in the United States. This post delves into the essentials of the CTA and what it means for you as a cannabis business owner.

What is the Corporate Transparency Act?

The Corporate Transparency Act was enacted to help law enforcement and regulatory agencies detect and prevent financial crimes like money laundering, terrorism financing, serious tax fraud, and other illicit activities facilitated through anonymous shell companies. By requiring corporations and LLCs to disclose their beneficial owners, the CTA seeks to peel back the layers of secrecy often associated with these entities.

Which federal agency administers the Corporate Transparency Act?

Under the CTA, most U.S. companies, including those in the cannabis industry, are required to report detailed information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury. The Director of FinCEN is appointed by the Secretary of the Treasury. In July 2023, Treasury Secretary Janet Yellen appointed Andrea Gacki as FinCEN Director. Gacki was the former head of the Office of Foreign Assets Control (OFAC).

Who Must Comply?

The reporting obligations apply to both domestic companies formed in any U.S. state (also including Indian tribes, the District of Columbia, and any “commonwealth, territory, or possession of the United States) and foreign entities registered to do business in the U.S.

However, the Act outlines 23 specific types of entities that are exempt from the reporting requirements.

Definition of Beneficial Owner

A beneficial owner is defined under the CTA as an individual who either:

- Exercises substantial control over the company, or

- Owns or controls at least 25% of the ownership interests of the company.

It’s crucial to identify who these individuals are within a cannabis business as failing to report them could lead to civil and criminal penalties.

Five Exceptions to the Definition of Beneficial Owner

Under the Corporate Transparency Act, there are five exceptions to the definition of a beneficial owner, which help clarify who does not need to be reported as a beneficial owner:

- Minor Child: A minor child is not considered a beneficial owner, but reporting will likely be required once the minor reaches the age of majority.

- Nominee, Intermediary, Custodian, or Agent: Individuals serving purely as nominees, intermediaries, custodians, or agents on behalf of another individual are excluded from being reported as beneficial owners.

- Employee: Employees, with some exceptions, are generally not counted as beneficial owners.

- Inheritor: An individual with a future ownership interest by way of inheritance is exempt from being considered a beneficial owner, but once the property is inherited, reporting is likely required.

- Creditor: Creditors, including those with a financial interest or certain rights over the company’s assets, are not beneficial owners unless they meet other criteria for substantial control or ownership.

These exceptions aim to streamline reporting requirements.

Penalties

The penalties for violating the Corporate Transparency Act (CTA) are significant, reflecting the serious nature of the compliance requirements. Failing to accurately report beneficial ownership information can result in both civil and criminal penalties under federal law. Failing to report accurate information or knowingly providing false or fraudulent information can result in civil penalties of up to $500 per day and criminal penalties including a fine of of up to $10,000 and/or imprisonment for up to two years. 31 U.S.C. § 5336(h)(1).

Subsection 5336(h)(2) prohibits any person from knowingly disclosing or using beneficial ownership information obtained through a report submitted to FinCEN, without authorization, punishable with imprisonment for up to five years. If the violation of 31 U.S.C. § 5336(h)(2) was committed while violating another law of the United States, the maximum punishment is doubled to ten years.

These penalties underline the importance of maintaining compliance with the CTA and ensuring that all reporting is complete, accurate, and timely. For businesses in the regulated cannabis industry, it’s particularly crucial to adhere to these regulations, given the additional scrutiny often placed on the industry.

Reporting Requirements and Deadlines

Entities must submit beneficial ownership information (BOI) through a purportedly secure electronic system managed by FinCEN.

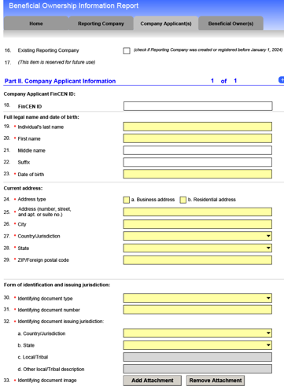

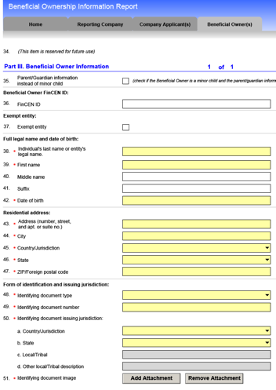

The screenshots below illustrate the types of information provided: Reporting Company Information, Company Applicant Information (only for entities formed or registered on or after January 1, 2024), and Beneficial Owner Information.

Reporting Company Information

Company Applicant Information (for entities formed or registered after January 1, 2024)

Beneficial Owner Information

For companies created before January 1, 2024, there is a deadline of January 1, 2025, to file their initial BOI reports.

Companies formed or registered in 2024 (between January 1, 2024, and January 1, 2025), have 90 days post-formation or post-registration to comply.

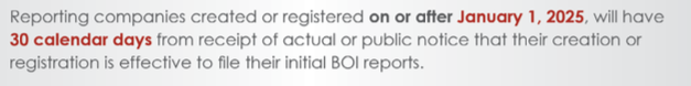

Companies formed or registered on or after January 1, 2025, have only 30 days to file their initial Beneficial Ownership Information reports.

When there is a change of information, updated reports are due within 30 calendar days after a change occurs.

FinCEN FAQs

The FinCEN identifier under the Corporate Transparency Act (CTA) can be issued to two types of applicants: individuals and reporting companies. Below is an overview of each type, including the advantages and disadvantages of obtaining a FinCEN identifier.

FinCEN Identifiers

The FinCEN identifier under the Corporate Transparency Act (CTA) can be issued to two types of applicants: individuals and reporting companies. Below is an overview of each type, including the advantages and disadvantages of obtaining a FinCEN identifier.

- Individual FinCEN Identifier:

- Issued to: An individual who may be a beneficial owner or company applicant.

- Purpose: To simplify the reporting process by using the identifier in lieu of repeatedly providing detailed personal information for every transaction or registration involving different entities.

- Entity FinCEN Identifier:

- Issued to: A reporting company.

- Purpose: Used by the entity itself to streamline reporting and updating beneficial ownership information.

Pros of Obtaining a FinCEN Identifier

- Simplified Reporting: Both individual and entity identifiers simplify the process of submitting and updating information. Instead of repeatedly filling out comprehensive forms, the identifier can be used to reference the necessary details.

- Consistency: Using an identifier helps maintain consistency in how information is reported across different filings and transactions.

- Security: By reducing the amount of personal information repeatedly submitted, identifiers can potentially decrease the risk of data breaches or misuse of personal data.

Cons of Obtaining a FinCEN Identifier

- Privacy Concerns: While the identifier limits the spread of personal information, the centralized nature of its storage might raise concerns about privacy and data security.

- Administrative Overhead: Although it streamlines reporting, obtaining and managing a FinCEN identifier requires initial and ongoing administrative effort to ensure accuracy and compliance. Once obtained, a FinCEN identifier must be updated indefinitely. Currently, there is no way to rescind a FinCEN identifier.

Obtaining a FinCEN identifier is a strategic decision that can offer significant benefits in terms of efficiency and consistency in reporting under the CTA. However, it also comes with responsibilities and potential privacy considerations that need to be carefully weighed.

Legal Challenges and Current Status

The CTA has faced constitutional challenges, notably in the case of National Small Business United v. Yellen, where it was declared unconstitutional by a federal judge in Alabama. However, an appeal is currently pending before a federal appellate court, the Eleventh Circuit, and the law remains enforceable for businesses that are not parties to that specific litigation. There are similar legal challenges making their way through the courts in other parts of the country, and owners of cannabis businesses should consider whether they would benefit from an injunction declaring the CTA unconstitutional and relieving cannabis business owners from the obligation of registering with FinCEN.

Implications for Cannabis Businesses

For cannabis business owners, compliance with the CTA is crucial, given the industry’s heightened scrutiny and the complex regulatory environment. Understanding and adhering to the CTA can help safeguard your business from legal risks and contribute to broader efforts against financial crimes.

Conclusion

As the legal landscape evolves, staying informed about legal developments like the Corporate Transparency Act is vital for cannabis business owners. Ensuring compliance not only helps in avoiding penalties but also enhances the legitimacy and operational transparency of your business in the highly regulated cannabis market.

For detailed guidance tailored to your specific circumstances, please consider consulting with legal experts familiar with cannabis law, corporate law, and the Corporate Transparency Act.

Resources

- The Corporate Transparency Act by Omar Figueroa, Continuing Legal Education presentation on April 25, 2024, hosted by the Sonoma County Bar Association. Slides can be viewed below.

Presentation slides

- Text of the Corporate Transparency Act

- Text of Reporting Rule codified in the Code of Federal Regulations

- FinCEN Small Entity Compliance Guide

- District Court Opinion in National Small Business United v. Yellen declaring the CTA unconstitutional

This information is intended as a public educational service and is not intended, nor should be construed, as legal advice. For further questions about the Corporate Transparency Act (CTA) as well as detailed guidance tailored to your specific circumstances, please contact the Law Offices of Omar Figueroa at 707-829-0215 or info@omarfigueroa.com to schedule a confidential legal consultation.